Pin on Quick Saves

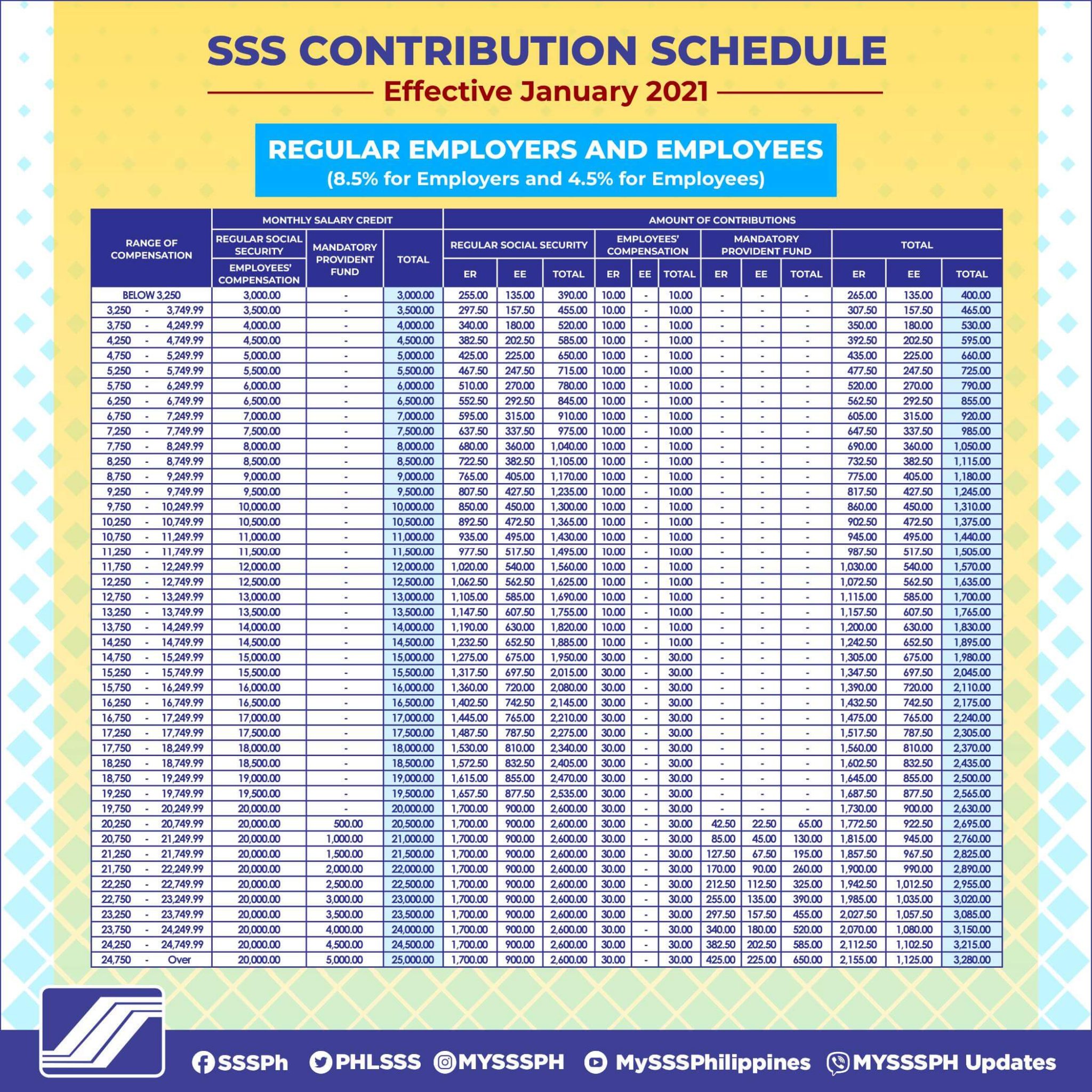

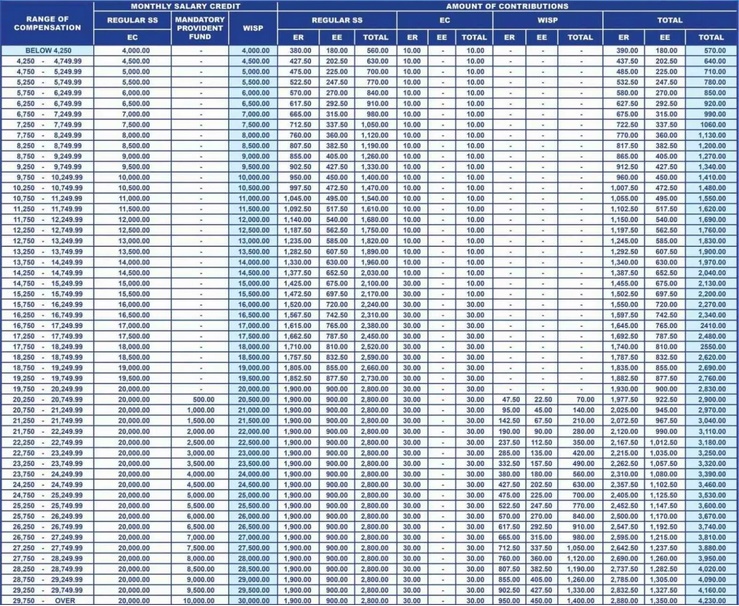

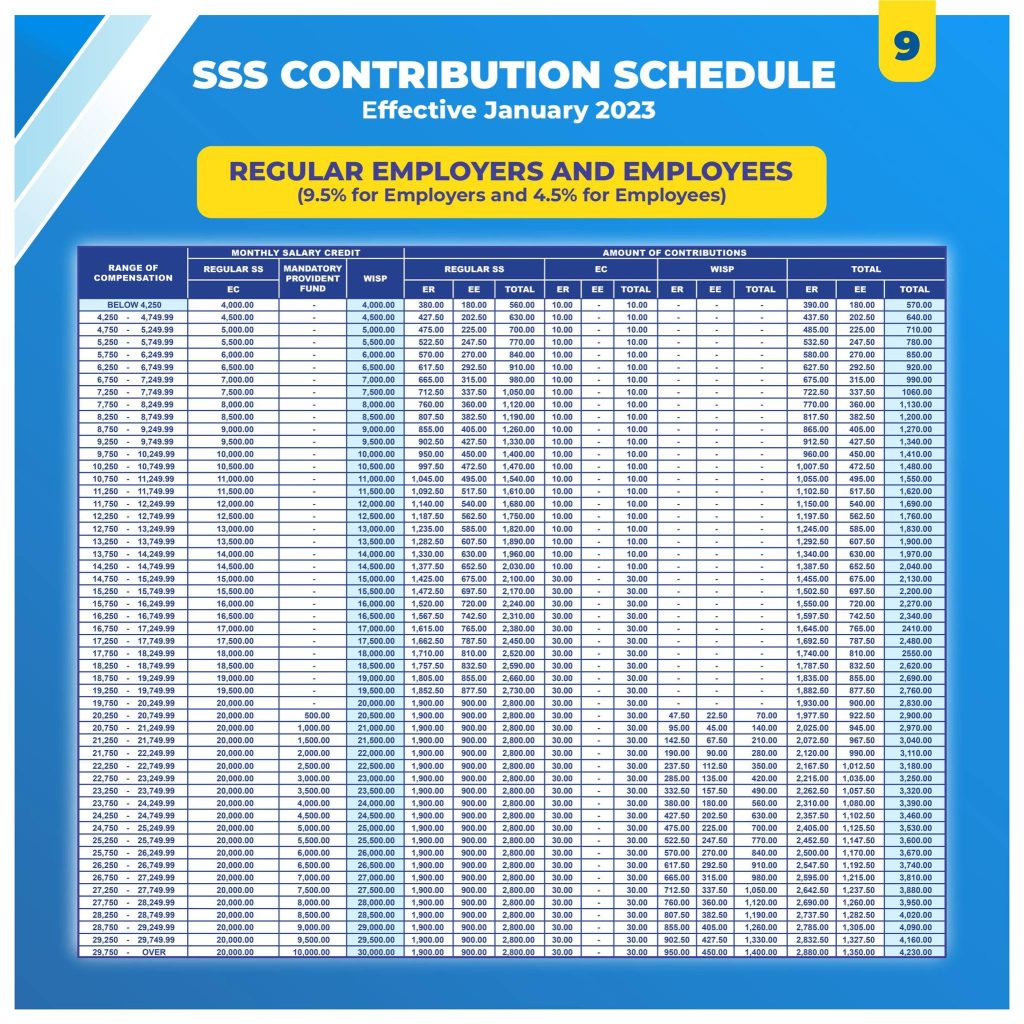

For employees and employers of a company here in the Philippines, the changes on the new SSS Contribution has taken effect since January 2023. You have probably noticed this increase on contribution rate if you have paid a contribution for these past few months. These are the notable changes on 2023 SSS Contributions:

What’s New SSS Contribution Table 2021 QNE Software

COVERAGE & COLLECTION PARTNER / CONTRIBUTION SUBSIDY PROVIDER SMALL BUSINESS WAGE SUBSIDY PROGRAM Member Login Register. Employer Login. SSS Building East Avenue, Diliman Quezon City, Philippines. For comments, concerns and inquiries contact: SSS Hotline: 1455.

Rate SSS Contribution 2023 Here's Guide on How Much You Must Pay as

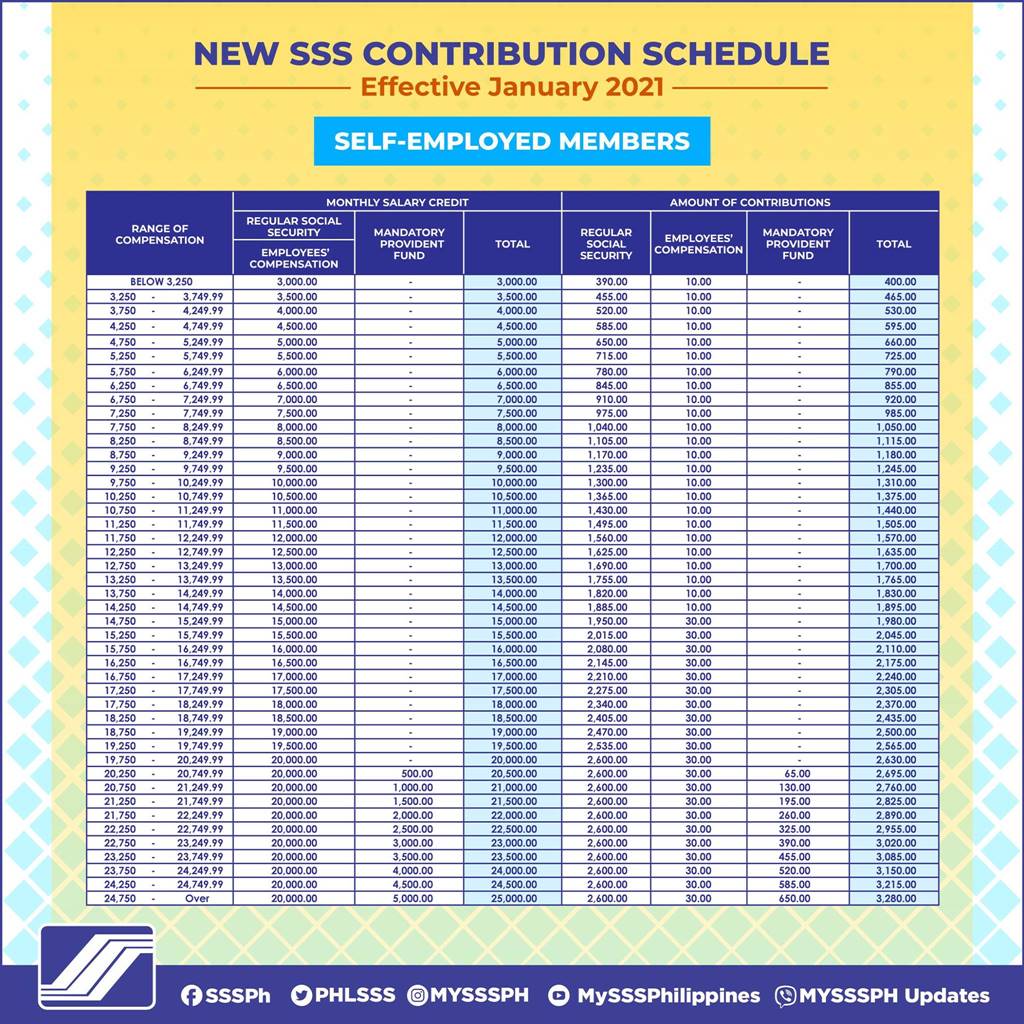

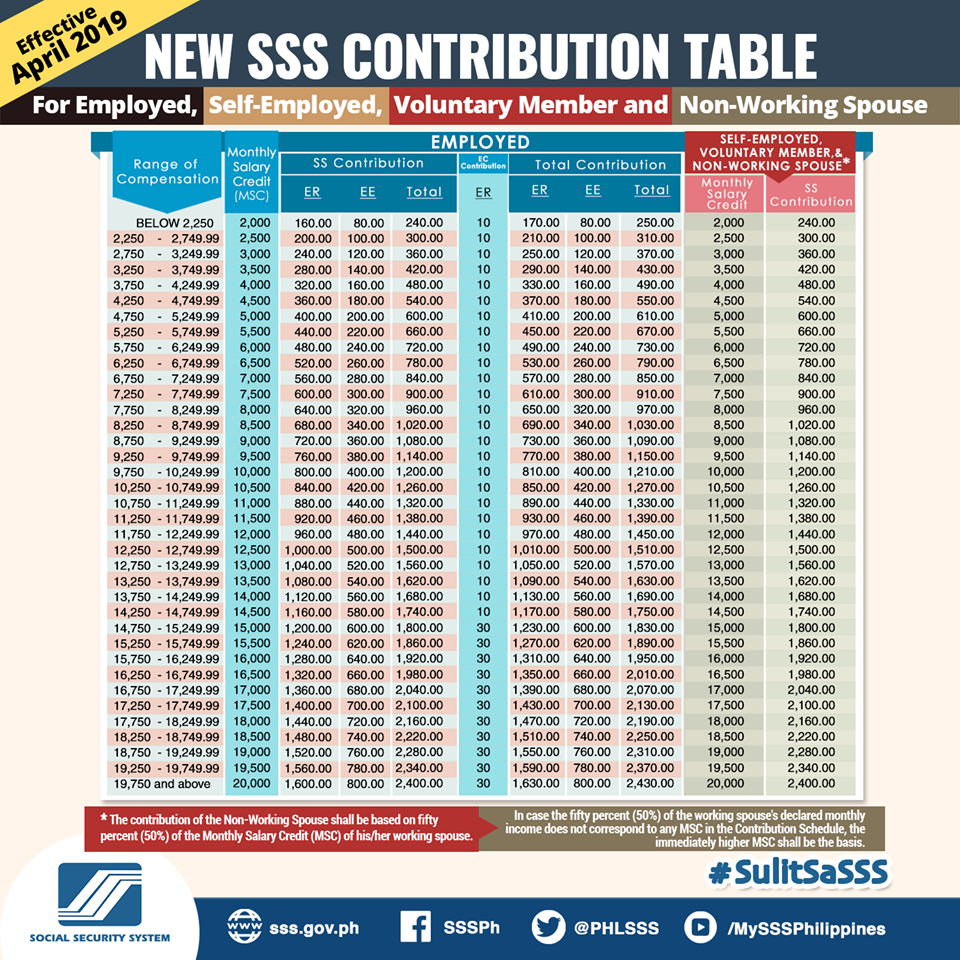

New SSS Contribution Table for 2023 2023 Update: Based on SSS Circulars No. 2022-033, 034, 035, 036, and 037 signed by SSS President and CEO Michael G. Regino, the contribution rate for 2023 is 14%, which is one percent higher than for the previous year.

New SSS Contribution Table 2023 (Everything you need to know) SSS Answers

Step 1: Visit the SSS Website Access the SSS website at www.sss.gov.ph. Upon entering the website, an I'm not a robot pop-up will appear. Check the box and click Submit. Step 2: Log in to Your My.SSS Account

How to Compute for SSS Contribution « EPINOYGUIDE

What is SSS? Why is SSS important for retirement? How do I benefit from it? How to Apply for an SSS Number How to apply for SSS online Member Data Amendments SSS Online Registration: Creating an Online Account for your SSS Step 1: Go to the SSS website's online registration page Step 2: Click the "Not Registered" option on the lower-right corner

BIR Tax Information, Business Solutions and Professional System SSS

SSS Building East Avenue, Diliman Quezon City, Philippines. 02-1455 or 8-1455. https://crms.sss.gov.ph

How much is SSS contribution per month? Bestbrainz Philipines

If you're not familiar with how to pay SSS contributions, the first step is to generate your employees' Payment Reference Number (PRN). You can log into your SSS account to do this. After generating the PRN, you can submit it along with the payment amount through any partner center.

SSS Contribution Table and Deadline of Payments Business Tips Philippines

Simply go to this website: https://www.sss.gov.ph/sss/rcsmi/main.html to get started and take the following steps: Accomplish all fields of the online form correctly. A link shall be sent to the registrant's email which will enable them to continue with their SS Number application.

50 best ideas for coloring Sss Employees Contribution Table

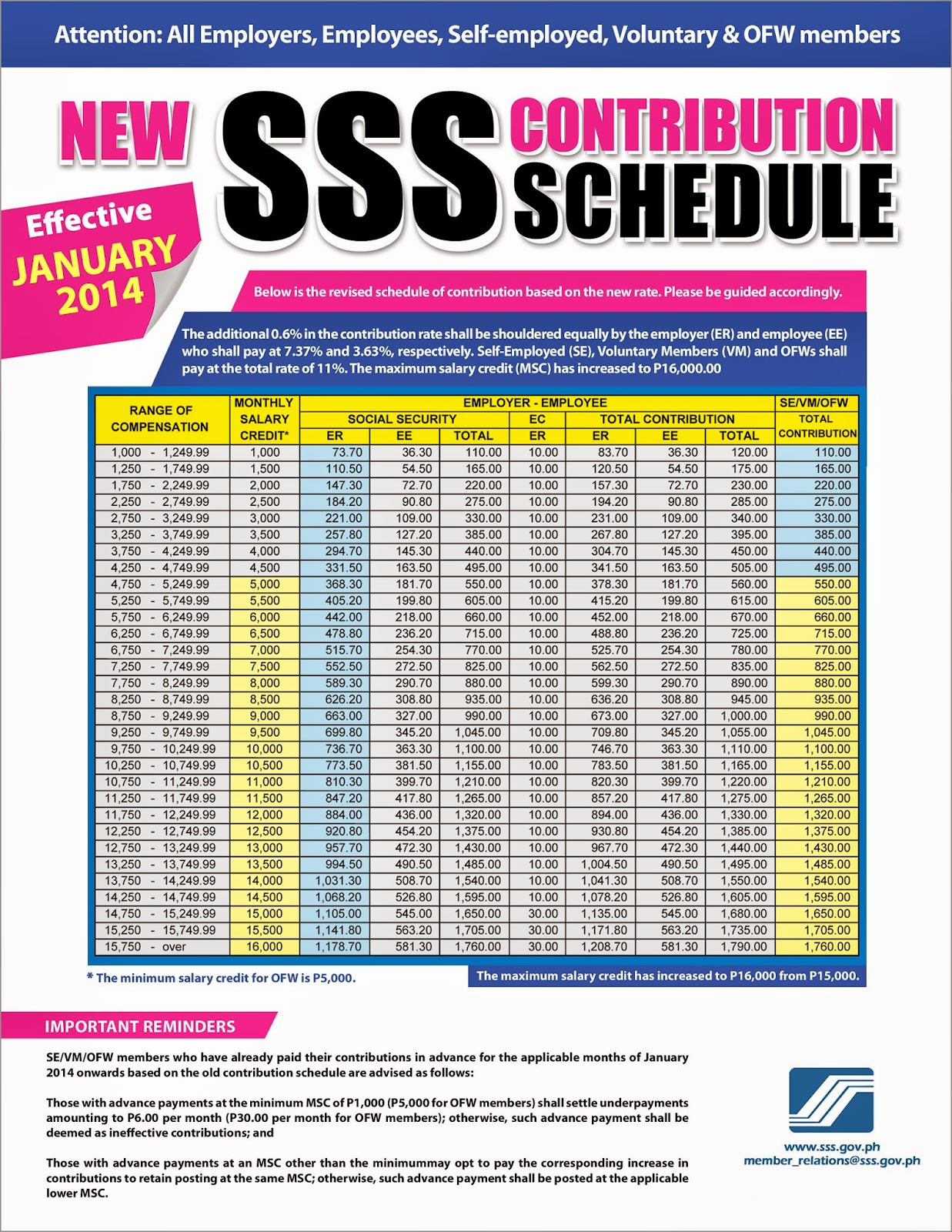

4. Calculate your Monthly Contribution. To calculate your monthly contribution, multiply your monthly salary credit by your contribution rate. Continuing with the example above, if your monthly salary credit is Php 20,000 and your contribution rate is 4.5%, your monthly contribution would be Php 900 (20,000 x 4.5%).

SSS Monthly Contribution Table & Schedule of Payment 2023 The Pinoy OFW

Members pay a monthly contribution to this government agency, and SSS uses it to provide benefits like retirement pensions and salary loans. You may have been wondering how much you're giving to SSS, and we've made this guide to help you compute your monthly SSS contribution.

SSS Contributions Table and Payment Deadline 2020 SSS Inquiries

Choose Pay Bills and then Gov't Contributions on the left sidebar. 3. Select the Payment Type. 4. Select Payor Type. 5. Enter your Payment Reference Number (PRN) if you have one. 6. If you don't have a Payment Reference Number, choose Click Here to generate one.

SSS Monthly Contribution Table & Schedule of Payment 2022 The Pinoy OFW

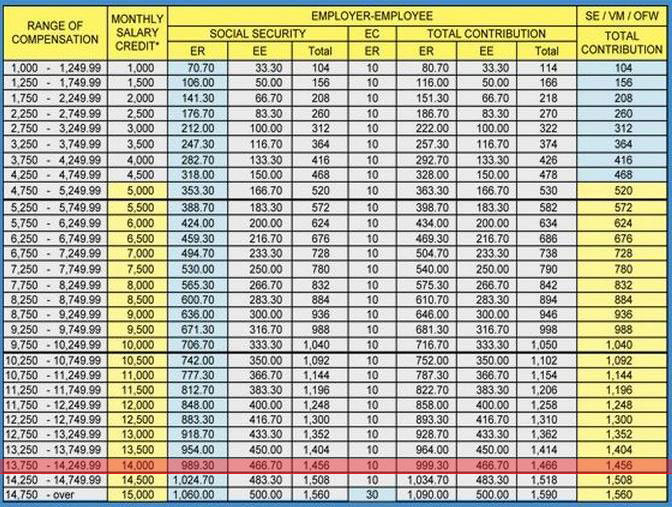

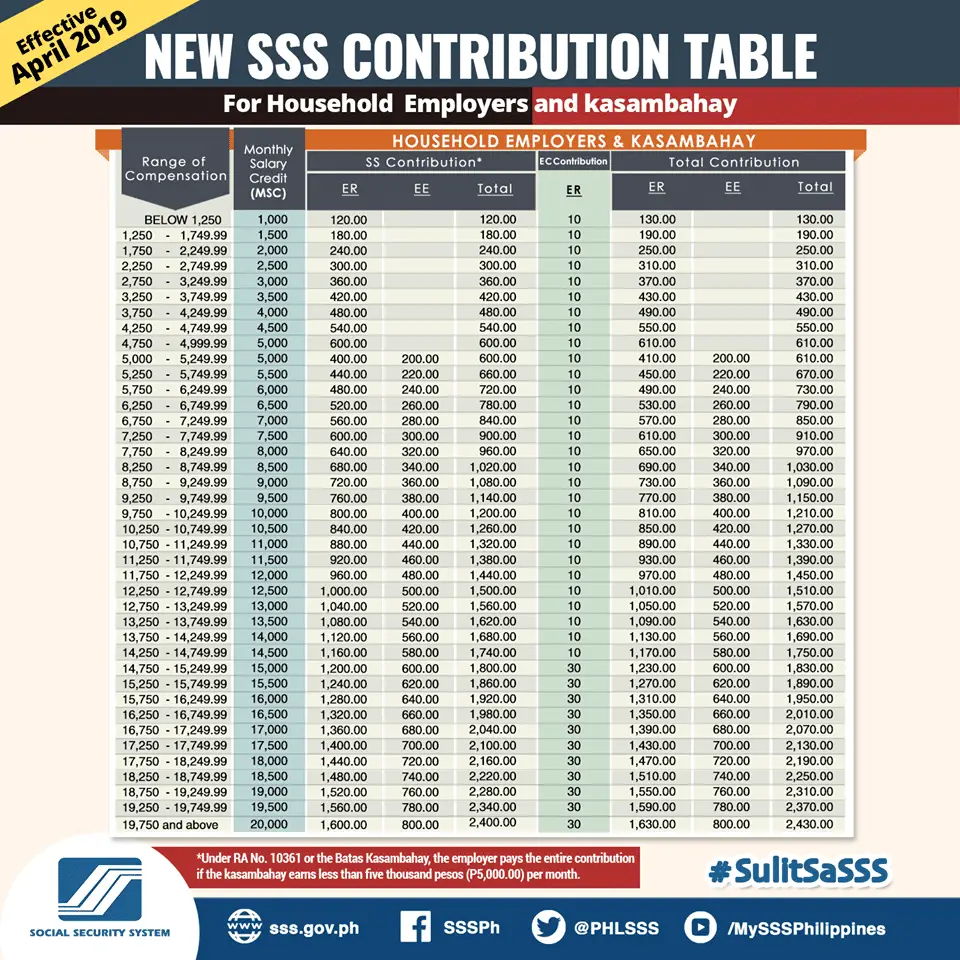

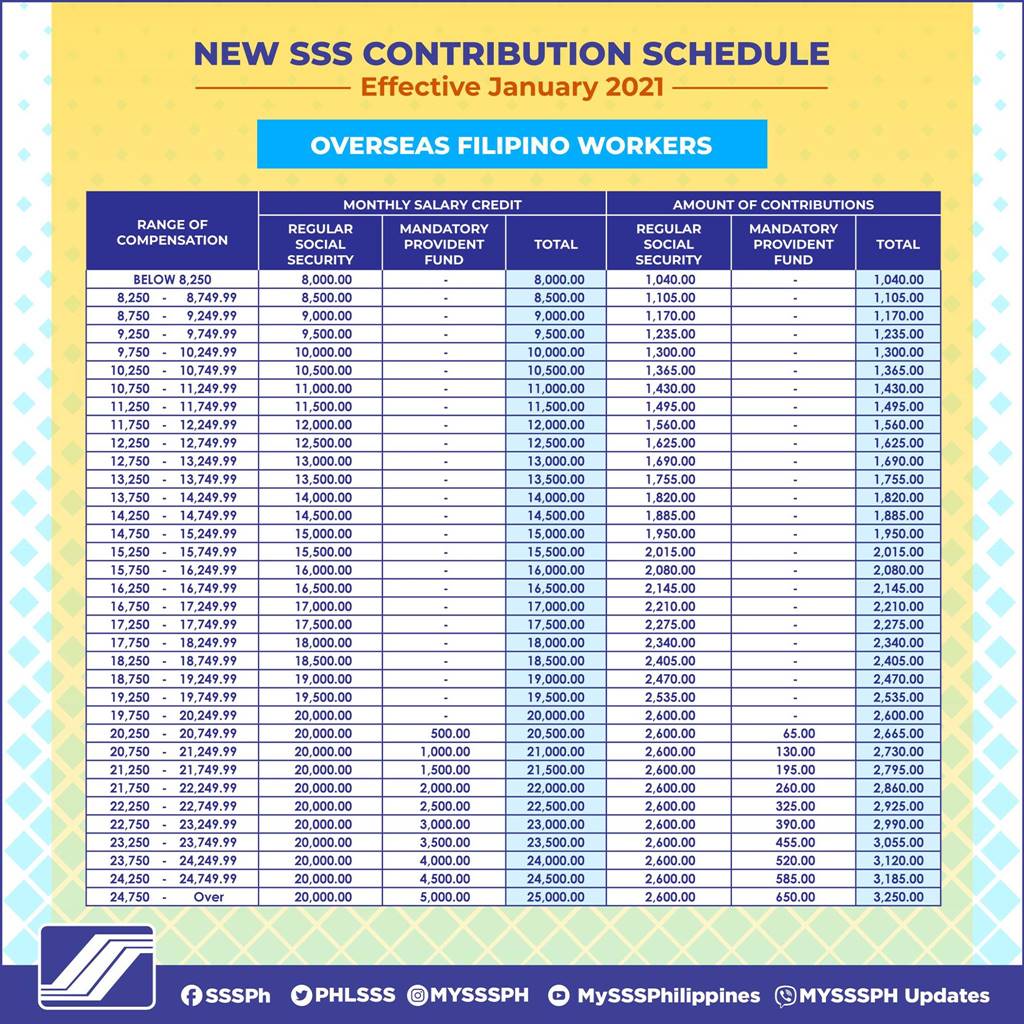

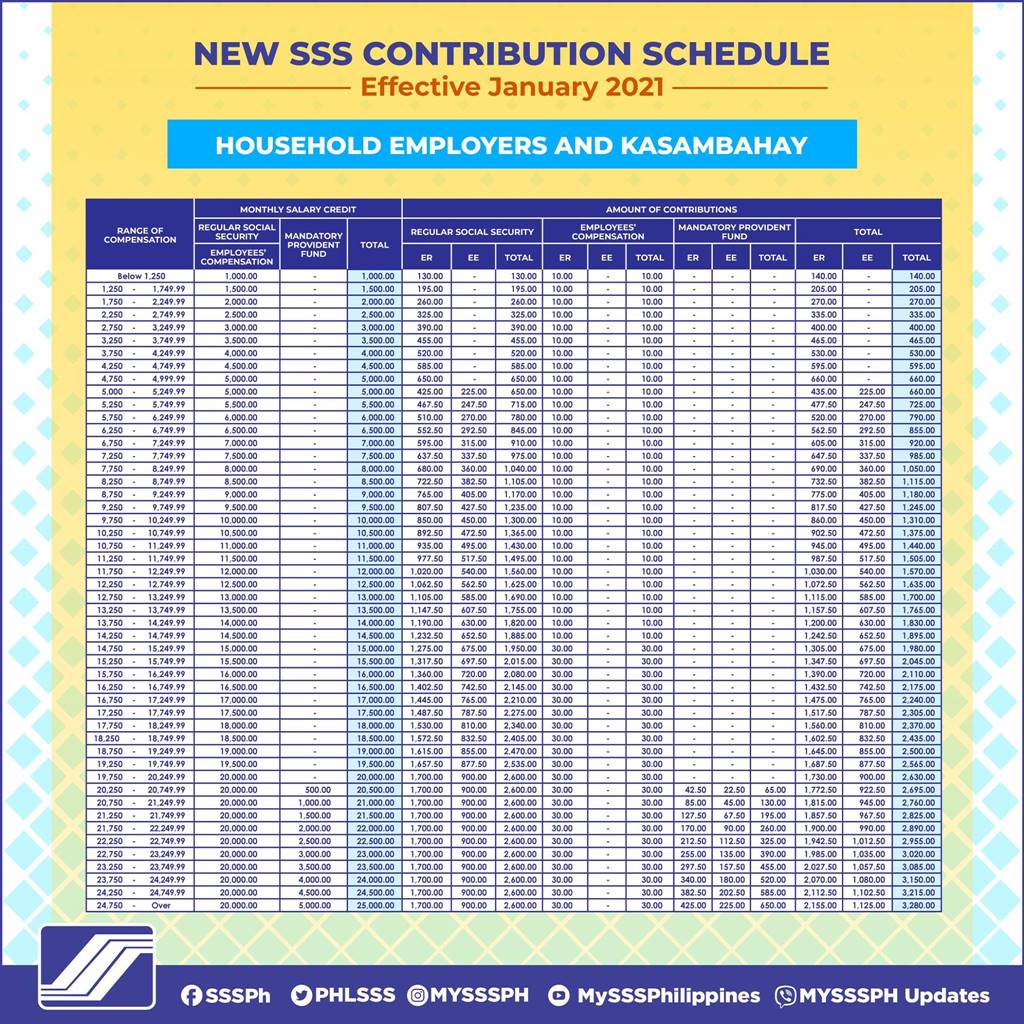

Who Can Pay SSS Contribution? Why Pay Your Contribution Regularly? How To Compute Your Monthly SSS Contribution: The Basics The New SSS Contribution Schedule The 2023 SSS Contribution Table 1. Employed Members 2. Self-employed Members 3. Voluntary and Non-Working Spouse Members 4. OFW Members 5. Household Employers and Kasambahay Tips and Warnings

Sss Contribution Online Payment Guide For Ofw Self Employed And

SSS Contribution Table for 2024. December 18, 2023. As the year draws to a close, it's time to gear up for potential updates in various government agencies' rates and fees, including the Social Security System (SSS). Every new year may usher in changes, and it's important to be informed about these adjustments.

SSS Contribution Table 2023 SSS Answers

The Social Security System released the new SSS contribution brackets for 2024. Effective January 2024, SSS members must comply with the updated monthly contributions to maintain their active membership status.

SSS releases contribution table for OFWs; P2,400 premium payment takes

The amount of contribution ranges from PHP 560 to PHP 4,200 per month. Calculate your SSS Contributions for Voluntary and Non-Working Spouse Membership with our SSS Contribution Calculator. Benefits of Voluntary Contributions for Non-Working Spouses Voluntary and non-working spouse members may be eligible to receive the following benefits: 1.

SSS Online Registration and Steps to Check SSS Your Contribution Online

2023 SSS Contribution Table for Overseas Filipino Workers (OFWs) Meanwhile, below is the new SSS Contribution Table for OFW Members, indicating that the minimum monthly salary credit is PHP 8250.00. Please take note of the difference between land-based OFWs in countries that have bilateral labor agreements with the Philippines, along with sea-based OFWS, as compared to land-based OFWs in.